The Income Approach to Value is one of the primary methods used by appraisal districts in Texas to determine the value of commercial real estate. This approach is particularly useful for income-generating properties, such as office buildings, retail centers, and apartment complexes, as it evaluates the property’s ability to produce income. Here’s a breakdown of how appraisal districts in Texas utilize market data to apply the Income Approach:

1. Estimate Potential Gross Income (PGI)

- Market Rents: Appraisal districts collect data on typical rents for comparable properties in the local market. This data is often obtained from surveys, property management reports, or real estate databases. They estimate the rent a property could command if fully leased at market rates.

- Vacancy and Collection Loss: Not all commercial properties will be fully leased or receive all the rent they are owed. The appraisers estimate a reasonable vacancy and collection loss factor based on market conditions, which is deducted from the potential gross income to arrive at Effective Gross Income (EGI).

2. Operating Expenses: Appraisal districts also gather data on typical operating expenses for similar properties, including:

- Property management fees

- Maintenance and repairs

- Utilities

- Insurance

- Property taxes

- Other operational costs specific to the property type.

These expenses are deducted from the EGI to determine the Net Operating Income (NOI). Operating expenses exclude items like mortgage payments (debt service) and depreciation, which are not directly tied to the property’s operational performance.

3. Capitalization Rate (Cap Rate): The next step involves determining the appropriate capitalization rate. The cap rate represents the investor’s expected rate of return on the property and is derived from market data, including sales of comparable properties and published cap rate surveys. The cap rate reflects local market conditions, investor expectations, and the risk associated with the specific type of property.

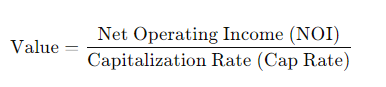

The formula used is:

This formula calculates the property’s value based on its income-producing potential.

4. Market Data Collection

- Sales Comparables: Appraisers gather information on recent sales of comparable income-producing properties to ensure the applied cap rates are in line with the market.

- Lease Data: Lease rates, lease structures (e.g., triple net, gross leases), and tenant credit quality are examined to estimate both market rents and expected operating expenses.

- Economic Trends: Local economic conditions, such as employment rates, new developments, and interest rates, influence both cap rates and anticipated future income growth, affecting overall property valuation.

5. Adjustments

- Appraisers might make adjustments based on the condition, location, or specific characteristics of the subject property compared to market data.

- For example, a property with long-term leases and stable tenants might warrant a lower cap rate (and higher valuation) than a similar property with short-term leases or high tenant turnover.

6. Final Valuation: After estimating the NOI and applying an appropriate cap rate, the appraisal district arrives at an estimated market value. This value is used for property tax assessments.

Importance of Market Data

Appraisal districts depend heavily on accurate and up-to-date market data, including:

- Lease rates

- Sales transactions

- Cap rates from actual sales

- Local economic indicators

By staying informed on current market conditions, the districts can generate fair valuations. However, discrepancies in data collection or analysis can lead to over- or under-valuations, often necessitating appeals by property owners or utilizing a knowable commercial property tax consulting firm such as Alamo Ad Valorem.

This method ensures that the value assigned to a property reflects its income-generating potential, which is central to understanding the real estate market in Texas, especially for investors or businesses focused on cash flow.

If you believe your property has been over-assessed or feel that the appraisal district is not considering your property’s unique circumstances, we encourage you to contact our office at (210) 952-4114. Our licensed property tax consultants are ready to assist you in achieving a fair and accurate valuation.