Our Tax Reduction Process

We have developed a winning formula to help our clients achieve results

File Your Protest

Sign up with us before the property tax protest deadline and our team will file the protest on your behalf.

Prepare Evidence

We analyze and prepare an expert opinion of value report to present before an appraiser or Appraisal Review board.

Fight Aggressively

We will attend informal and formal hearings on your behalf to aggressivly negotiate a reduction of your property taxes.

Big companies see numbers. We see people."

As a small, veteran-owned business, we take pride in delivering personalized service with integrity. Get the service you deserve!

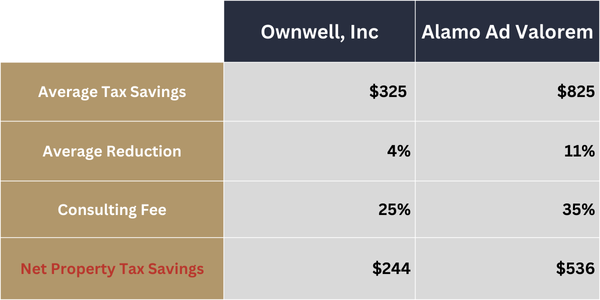

Quality of Service Matters

Don’t end up paying more in property taxes because the “other guys” charged less

Average savings of $292 more

A lessor rate could sound enticing at first, but in this case, it cost taxpayers an average of $292 more in property taxes per property.

2024 Protest Season Results Comparison

* Average tax savings based on an average tax rate of 2.2%

** Commercial consulting fees are less, please inquire for a fee quote

Commercial

We are a full-service property tax protest company serving commercial property owners by helping reduce the #1 NOI killer, “PROPERTY TAXES”. Our experts specialize in commercial real estate appeals and conduct the entire appeal process on your behalf. We possess thorough knowledge of property assessment appeals, tax laws, and property valuation schedules. Utilizing the wide range of resources at our disposal, we can help you save on property taxes. We take care of the property tax protest process so you can focus on what matters most!

Residential

We know that fighting your own property taxes can be a grueling process to deal with. As one of Texas leading property tax protest companies, here at Alamo Ad Valorem, we do all the heavy lifting to help reduce your yearly property tax increase. Do not navigate the sea of a complicated property tax appeal process alone, send a shark! Our team of experts will manage the entire property tax protest process from beginning to end while you enjoy peace of mind.

WHY CHOOSE ALAMO AD VALOREM?

Client Focused

By understanding that every property matters to you, we place a tremendous importance on satisfying all our client’s demands. We strive to work each property thoroughly and effectively to maximize your tax savings no matter how long the job takes.

Relationships Matter

We have one of the best client retention rates in our industry. This is because we make a concerted effort in building a relationship with each of our clients. Alamo Ad Valorem could not be in business if it were not for our amazing clients!

High Success Rate

Our team is knowledgeable of the different appraisal methods and understand the tax laws thoroughly. Combined with our state-of-the-art valuation software, we can aggressively negotiate lower property valuations throughout Texas.

Customized Approach

We do not believe in the one-size-fits-all approach. Therefore, we guarantee that we will customize our services and plans to know what is best for your property/portfolio. With this approach, we can work towards effectively lowering your property taxes.

Annual Representation

What our customers appreciate most is our yearly representation. Once you sign up with us, we will automatically continue working on your property tax protest every tax season. Preventing you from missing the deadline!

We use every statue available in the Texas Property Tax Code to reduce your property tax burden. This includes binding arbitration or litigation. Every case is different, and results vary from case by case, but we ensure that you are being valued according to the tax laws.

Commercial

San Antonio Technology Center

Bexar County 31% REDUCTION

San Antonio Technology Center

Notice Market Value: 8,670,380 Final Market Value: 6,000,000 Saved $61,033 in Property Taxes

Fmr Spaghetti Warehouse

Bexar County 45% REDUCTION

Fmr Spaghetti Warehouse

Notice Market Value: 4,069,780 Final Market Value: 2,240,000 Saved $44,649 in Property Taxes

Whatever Storage

Guadalupe County 44% REDUCTION

Whatever Storage

Notice Market Value: 2,440,000 Final Market Value: 1,374,840 Saved $15,483 in Property Taxes

Barkaritaville Pet Resort

Nueces County -43.52% REDUCTION

Barkaritaville Pet Resort

Notice Market Value: 3,298,866 Final Market Value: 1,863,046 Saved $30,601 in Property Taxes

Blanco Center

Bexar County -39.52% REDUCTION

Blanco Center

Notice Market Value: 1,438,430 Final Market Value: 870,000 Saved $14,170 in Property Taxes

Parkway Storage

Bexar County -28.78% REDUCTION

Parkway Storage

Notice Market Value: 11,232,050 Final Market Value: 8,000,000 Saved $74,191 in Property Taxes

Baymont by Wyndham

Victoria County 41% REDUCTION

Baymont by Wyndham

Notice Market Value: 2,933,480 Final Market Value: 1,726,630 Saved $28,935 in Property Taxes

A1 Self Storage

Bexar County 15% REDUCTION

A1 Self Storage

Notice Market Value: 4,703,030 Final Market Value: 4,000,000 Saved $19,641 in Property Taxes

Distribution Dr

Bexar County 38% REDUCTION

Distribution Dr

Notice Market Value: 2,293,070 Final Market Value: 1,413,265 Saved $22,630 in Property Taxes

Residential

River Front Property

Hays County 46% REDUCTION

River Front Property

Notice Market Value: 881,960 Final Market Value: 477,480 Saved $5,885 in Property Taxes

Elmira St Property

Bexar County 50% REDUCTION

Elmira St Property

Notice Market Value: 761,250 Final Market Value: 380,000 Saved $9,303 in Property Taxes

Woodlawn Apartments

Bexar County 59% REDUCTION

Woodlawn Apartments

Notice Market Value: 526,630 Final Market Value: 215,000 Saved $7,604 in Property Taxes

Yellowstone Lots

Bexar County -56.70% REDUCTION

Yellowstone Lots

Notice Market Value: 1,085,050 Final Market Value: 469,800 Saved $15,337 in Property Taxes

Ranch Falls Homestead

Kendall County -51.02% REDUCTION

Ranch Falls Homestead

Notice Market Value: 2,348,970 Final Market Value: 1,150,520 Saved $20,091 in Property Taxes

Montclaire Rental

Travis County -31.02% REDUCTION

Montclaire Rental

Notice Market Value: 1,087,254 Final Market Value: 750,000 Saved $6,661 in Property Taxes

Landa Park Estates

Comal County 28% REDUCTION

Landa Park Estates

Notice Market Value: 1,942,320 Final Market Value: 1,395,000 Saved $11,092 in Property Taxes

Woodlawn Terrance

Bexar County 43% REDUCTION

Woodlawn Terrance

Notice Market Value: 409,060 Final Market Value: 235,000 Saved $4,863 in Property Taxes

Southtown/Fest St

Bexar County 28% REDUCTION

Southtown/Fest St

Notice Market Value: 1,371,400 Final Market Value: 990,000 Saved $10,656 in Property Taxes

Daniel and his firm have been successful in significantly reducing the valuation on many of my properties over several years. The professionalism, coupled with industry expertise makes for a very compelling case!

Alamo Ad Valorem has done a much better job protesting property taxes on my rental properties than the company I hired the previous year. Their payment structure is very fair. I would definitely recommend them to others.

I highly recommend Daniel.

He is an excellent person, very experienced and professional.

He is very straight forward and gets the job done. Great guy!

I have used Daniel Ortiz to protest my property taxes for two years in a row now, after using another company previously. Mr. Ortiz’s customer service has been far superior! His firm, Alamo Ad Valorem, has done a wonderful job dealing with the county on my behalf and has had great success. We are going to continue to use his firm in the future.

Read Latest Updates

What role do property tax companies play during the property tax protest process?

Just like you would hire a CPA for your tax matters or an attorney for your legal matters, a property tax consultant is an advocate who is well versed on the tax laws and district procedures, as well as possesing extensive knowledge on the appraisal methods utilized by the appraisal method. Having a tax consultant company by your side during your property tax protest, typically yields better results.

Can property tax protest companies guarantee results?

Not only is it against our code of ethics as property tax consultants, but it is also just plain wrong for a property tax protest company to promise a specific result. There are too many variables at play during the property tax protest that can hinder a property tax consultant’s result. However, a good property

tax appeal company will do everything in their power to fight for the best possible results.

What can I expect during the property tax protest process after hiring a property tax protest company?

Here at Alamo Ad Valorem, we take care of the entire property tax protest process for our clients. From filing your property tax appeal, gathering all the evidence the appraisal district will use, researching sales and neighboring appraisals, to presenting before the district’s appraiser and/or appraisal review board. The entire process could take up to four months from our May 15th filing date. Please note that the speed of the process depends on the jurisdictional appraisal district. Once everything is done, we’ll inform you of the results.