Get In Touch

"*" indicates required fields

Our Property Tax Reduction Process

We have developed a winning formula to help our clients achieve results

File Your Protest

Sign up with us before the property tax protest deadline and our team will file the protest on your behalf.

Prepare Evidence

We analyze and prepare an expert opinion of value report to present before an appraiser or Appraisal Review board.

Fight Aggressively

We will attend informal and formal hearings on your behalf to aggressivly negotiate a reduction of your property taxes.

Maximize your savings with Alamo Ad Valorem

Professional property tax protest and appeal services in the entire State of Texas

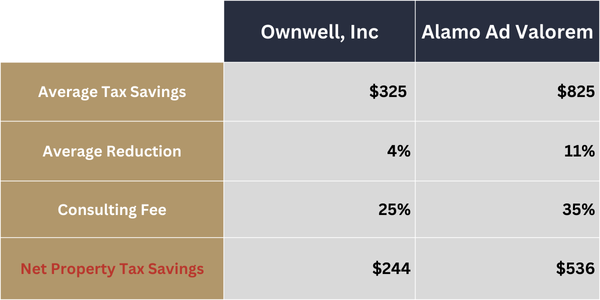

Quality of Service Matters

Don’t end up paying more in property taxes because the “other guys” charged less

Average savings of $292 more

A lessor rate could sound enticing at first, but in this case, it cost taxpayers an average of $292 more in property taxes per property.

2024 Protest Season Results Comparison

Our Commercial Rates differ from above, contact us for a commercial quote.

* Tax savings calculation based on the average Bexar tax rate of 2.6%. Individual results may vary. The study above is based on the total protested properties, commercial tax savings per property may be significantly higher.

Tax Payers Trust Alamo Ad Valorem

Don’t just take our word for it, read from our extensive list of customer testimonials.

Daniel and his firm have been successful in significantly reducing the valuation on many of my properties over several years. The professionalism, coupled with industry expertise makes for a very compelling case!

Alamo Ad Valorem has done a much better job protesting property taxes on my rental properties than the company I hired the previous year. Their payment structure is very fair. I would definitely recommend them to others.

I highly recommend Daniel.

He is an excellent person, very experienced and professional.

He is very straight forward and gets the job done. Great guy!

I have used Daniel Ortiz to protest my property taxes for two years in a row now, after using another company previously. Mr. Ortiz’s customer service has been far superior! His firm, Alamo Ad Valorem, has done a wonderful job dealing with the county on my behalf and has had great success. We are going to continue to use his firm in the future.

Read Latest Updates

Areas We Serve

We are leading property tax protest consultants, helping clients with all types of commercial and residential properties in the State of Texas.

ALAMO AD VALOREM

There are hundreds of reasons why hiring us as your property tax consultant in Texas can be beneficial. Here, we list only a few.

Aggressive Tax Reduction Strategies

We aggressively protest your residential property tax with the local appraisal district and implement the most effective strategies to ensure that you get your desired reduction.

Client-Focused Approach

Our proactive and experienced team has a laser-sharp focus on client requirements and can help them devise the best ways and means to reduce property taxes.

Personal Attention, Professional Service

Dealing with property tax appeals can be stressful and time consuming. At Alamo Ad Valorem, we add a dash of warmth to our professional expertise, becoming a partner in your fight for a fair and equitable valuation.

Transparent Fees & Pricing Structure

We have a performance-based payment model, which means you pay us only if we demonstrate results in most cases. This ensures that each member of our team is as invested in reducing your property tax as much as yourself.